By the time Maya Reynolds turned twenty-four, she had carved out a life that none of her family believed she was capable of. While her parents invested emotionally and financially in her younger sister, Chloe Reynolds, the designated “golden child,” Maya had quietly worked two jobs through college, launched a digital marketing firm from her studio apartment, and spent every night building connections, clients, and eventually, wealth.

By twenty-four, the student loans were gone. She bought a luxury loft in downtown Seattle—exposed brick, floor-to-ceiling windows, a skyline view she used to dream about. Her business reached its first million in revenue. She didn’t owe anyone anything. Especially not her parents.

They had barely congratulated her.

So when Maya opened her front door one March afternoon to find a thick envelope from a law firm she didn’t recognize, she assumed it was a contract issue. Instead, she found a neatly typed complaint:

Her parents were suing her for $500,000 in “raising fees.”

According to the filing, she owed them compensation for “eighteen years of food, shelter, education, and emotional labor.” The document went on to claim that since Maya was “financially stable,” she had a moral obligation—now converted into a legal one—to rescue the family from hardship.

That hardship had a name: Chloe.

Chloe, the golden child—twenty-two, no job, expelled from college for academic dishonesty—had racked up nearly six figures in credit card debt and tax issues. Her parents wanted Maya to pay for it.

Maya almost laughed. Almost.

Three days later, they called her, expecting panic. Instead, Maya asked only one question:

“Why file a lawsuit instead of talking to me?”

Her mother’s voice was cold: “Because talking to you never works. You always think you’re above us.”

Her father added, “We raised you. You owe us. Chloe needs help. Be a good daughter for once.”

Maya ended the call. Calm. Steady.

But anger simmered under her ribs, not because of the lawsuit—but because they believed she would break.

She met her attorney, Ryan Cooper, the next morning. He reviewed the complaint, brows climbing higher with every page.

“This is absurd. They don’t have a legal leg to stand on.”

“I know,” Maya said. “But I want to do more than win.”

Because inside her storage drive was something her parents didn’t know she had.

Financial documents. Fake church donations they claimed for tax deductions. Income they hid. Rental properties they never reported. All the little frauds Maya had discovered as a teenager while doing their household paperwork—long before she understood what she was looking at.

Now she understood perfectly.

Her parents had been playing with fire for decades.

So that night, Maya submitted everything—every fraudulent return, every falsified form—directly to the IRS.

And then she waited

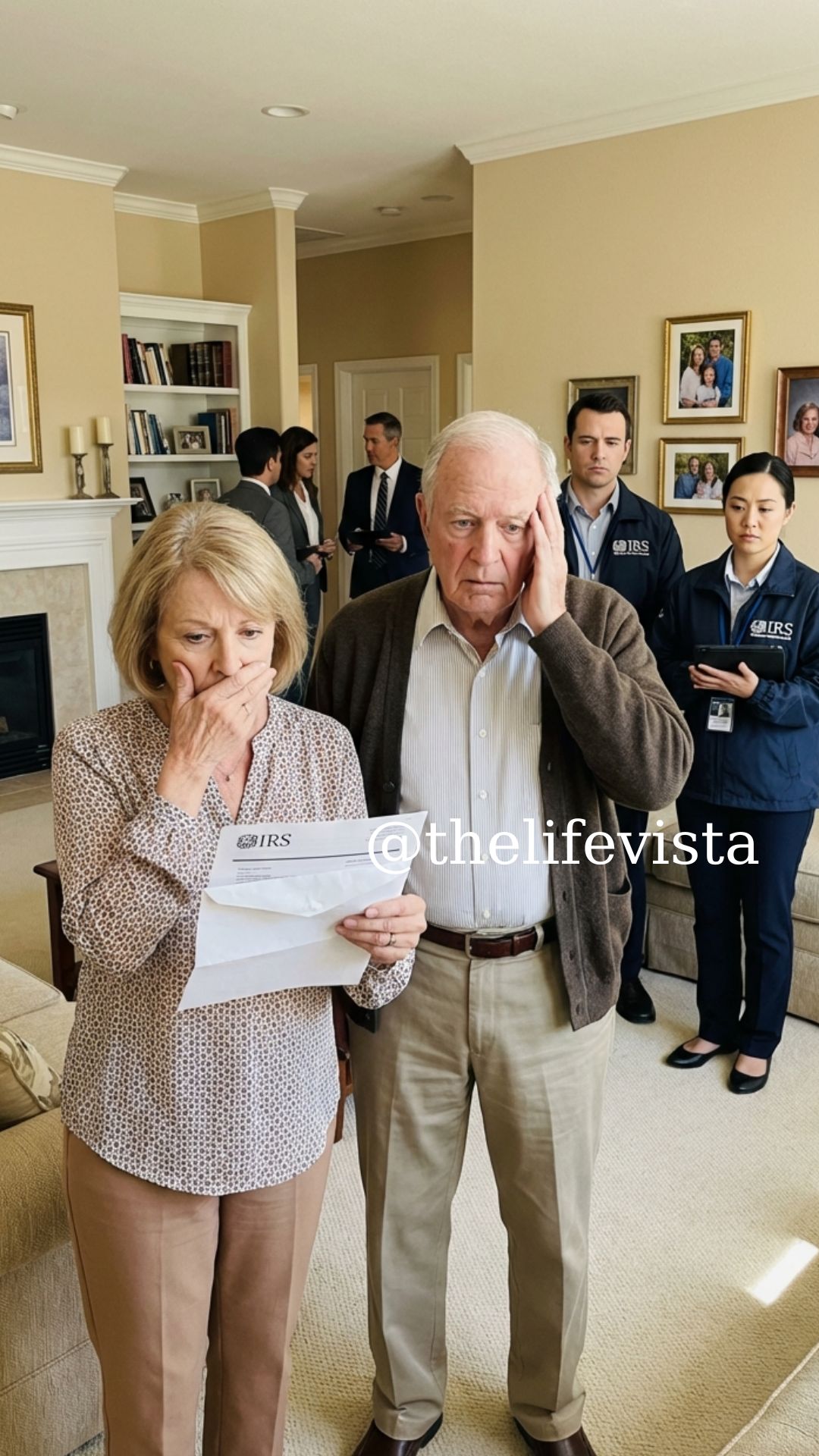

The IRS did not move quickly, but when it moved, it moved with precision. Maya first sensed the shift when her mother left her a voicemail—tight, clipped, and trembling

“Maya… call us back. It’s urgent.”

She didn’t.

Two days later, Ryan called. “You should sit down,” he said. “The IRS has opened an investigation into your parents. Someone must have sent them a… substantial packet.”

Maya almost smiled. “Not someone. Me.”

The silence on the other end held a hint of awe. “Well, they’ve taken it seriously. Agents visited their house this morning.”

The lawsuit didn’t disappear—not yet—but the tone changed dramatically. The confident emails from her parents’ attorney grew shorter, then tentative, and finally stopped altogether. Within weeks, new filings appeared: motions to delay, to reconsider, to restructure. The desperation was obvious, even through cold legal language.

Meanwhile, Maya lived her life. She expanded her office, hired three new employees, and signed a contract with a major tech company that doubled her firm’s projected revenue. But beneath her calm exterior was a quiet current—part justice, part exhaustion, part the kind of grief that only betrayal from family can create.

The true rupture came one Saturday afternoon when she returned from a meeting and found Chloe sitting on the steps outside her building.

Her once-polished sister looked disheveled—blonde hair uncombed, mascara smudged, hoodie wrinkled. She stood when Maya approached.

“You ruined everything,” Chloe said, voice shaking.

Maya unlocked the door with the keypad. “I didn’t ruin anything. They did.”

Chloe grabbed her arm. “The IRS froze their accounts. Mom says they could lose the house. How could you do that to us?”

Maya stepped back. “To us? Or to you?”

Chloe’s jaw clenched. “They only sued you because they needed the money. You have so much. Why couldn’t you just help?”

“Because it was never help,” Maya said quietly. “It was punishment disguised as obligation. And because you all assumed I’d sacrifice everything I built to fix your mistakes.”

Tears pooled in Chloe’s eyes—not of remorse, Maya realized, but anger. “You think you’re better than us.”

“No,” Maya said. “Just not controlled by you.”

Chloe left with a bitter glare, muttering something about betrayal.

That evening, Ryan emailed her:

“Their attorney is requesting a settlement meeting. They want to drop everything if you agree not to cooperate further with the IRS.”

Maya read it twice.

Then she typed back:

“No settlement. We proceed.”

Because it wasn’t about revenge anymore.

It was about ending the cycle—finally, irrevocably.

The IRS investigation escalated over the next two months. What began with document requests grew into full audits, interviews, and the discovery of even more undeclared income. Maya watched from a distance as the structure of her parents’ finances—the same structure they had claimed was “middle-class modest”—collapsed under scrutiny.

Their lawsuit was quietly withdrawn. No apology. No acknowledgment. Just retreat.

Ryan called her into his office the day the final withdrawal notice arrived.

“You understand what comes next for them,” he said.

Maya nodded. “Charges?”

“Highly likely. At minimum, massive penalties.”

She waited for guilt to arrive. It didn’t.

Instead, she felt something like clarity.

Her parents, however, were unraveling.

Her father emailed her first—long, rambling messages about family, forgiveness, mistakes. Her mother followed with shorter ones, alternating between denial and fury.

Chloe posted cryptic messages online about “fake siblings” and “traitors,” then deleted them.

But none of them called the lawsuit what it was: extortion disguised as parental entitlement.

One evening, while Maya worked on a proposal, her phone buzzed again—this time a number she didn’t recognize. She answered cautiously.

It was her father.

His voice sounded smaller than she had ever heard it. “Maya… we’re losing the house.”

She closed her laptop. “I’m sorry. But that isn’t my doing.”

“It is,” he said. “You could have helped.”

“Help,” she repeated. “You sued me. You tried to take half a million dollars from me to cover Chloe’s mess. And now you want me to feel responsible for the consequences of your choices?”

He didn’t answer.

Maya continued, “You wanted money from me, not a relationship. This is the outcome of treating your children like assets.”

He exhaled shakily. “Your mother is devastated.”

“No,” Maya said gently. “She’s scared. That’s different.”

When the call ended, she stared at the Seattle skyline, the lights shimmering against the dark water. She had built her life alone, brick by brick, while they dismissed her, minimized her, and finally tried to drain her.

Now the truth had simply surfaced.

The final blow came when the IRS formally filed charges—tax evasion, falsified returns, and a restitution demand large enough to wipe out everything her parents still owned. The news hit Chloe hardest; the facade of the golden child shattered as the family’s financial safety net evaporated.

Meanwhile, Maya continued upward—new office space, national clients, a growing reputation for resilience and precision.

Months later, standing on her rooftop balcony, she realized something: She no longer waited for their approval, their acknowledgment, or their understanding.

She didn’t need closure from them.

She had created her own.